Federal Reserve Inflation Nowcasting Data Shows Future CPI Increase, US Total Debt Hits $31 Trillion

A recently released forecast based on inflation nowcasting data from the Federal Reserve Bank of Cleveland indicates that future US consumer price index (CPI) indicators are likely to rise. The new projected CPI level was recorded on Oct. 4, the day America’s total national debt surpassed his $31 trillion.

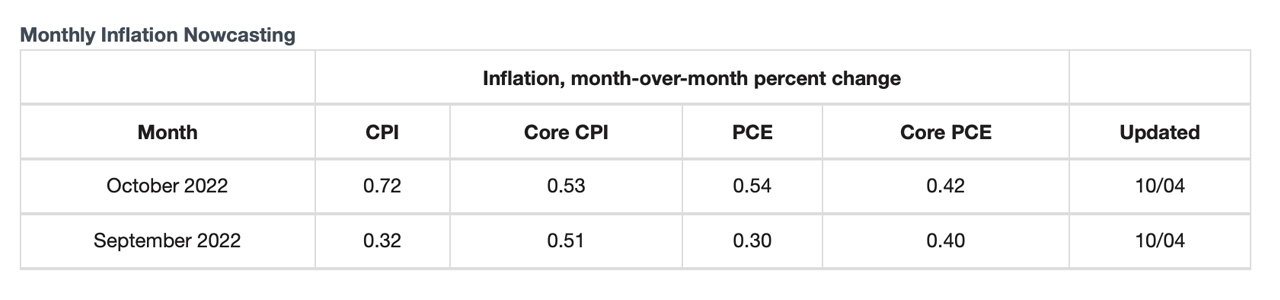

Fed’s Nowcasting report shows inflation may not have peaked, with data predicting core CPI jumping 0.5% in September and October

Despite criticism of the US Federal Reserve (Fed) for aggressively raising benchmark lending rates, the US central bank is less enthusiastic about slowing rate hikes if inflation remains rampant. maybe. Data from the latest Inflation Nowcasting report shows his CPI figures for September and October to be higher than expected. Nowcasting in economics is similar to a meteorologist predicting the weather because an economic indicator utilizes his three points in time (the present, the very near future, and the very near past) to predict future outcomes. Thing.

The Cleveland-based US Federal Reserve’s 4th District uses nowcasting to forecast future inflation increases, but the latest update is unfavorable. In the report, September is up 0.3% from the previous month, and in October he forecasts a 0.7% increase. The Cleveland Fed’s Inflation Nowcasting report also shows core CPI to increase by 0.5% in both months. Of course, the inflation nowcasting report is just a forecast, and like your local weatherman, the nowcasting can be right most of the time and the indicators can be wrong.

Americans won’t hear about the September CPI report from the US Bureau of Labor Statistics until October 13th. The Fed’s target is he’s 2%, but the inflation report for August showed the CPI still heating up at 8.3%. Another inflation statistic released by shadowstats.com on his Sept. 13 shows that the CPI is above 10%. The Truflation dashboard shows his CPI data for October 3, 2022 at 8.67% year-over-year. Data from shadowstats.com show a record high, but Truflation stats show he may have peaked at 11.93% on March 11, 2022.

US bureaucrats and the country’s central bank have blamed the country’s sharp inflation for reasons including the Covid-19 pandemic, supply chain shocks and the ongoing Ukraine-Russia war. It blames the US government and Fed for stimulus and spending following the outbreak of the pandemic. While the Federal Reserve has increased the money supply more than ever before in history over the past few years, the U.S. government has spent trillions of dollars on infrastructure her packages and foreign aid. Additionally, on Tuesday, October 4, 2022, the US total national debt surpassed her $31 trillion.

The New York Times (NYT) reported that a US Treasury Department report revealed that Treasuries have crossed the threshold. The NYT report quotes Michael A. Peterson, chief executive of the Peter G. Peterson Foundation, as saying higher interest rates could lead to higher government spending. The Peterson Foundation estimates that rising interest rates could add another $1 trillion to what the U.S. government will spend on interest payments in his decade.

“As debt grows and interest rates rise, many of the concerns about rising debt are starting to emerge,” Peterson said. “Too many people were not happy with the course of our debt, partly because interest rates were so low.”

What are your thoughts on the Cleveland Fed’s Inflation Nowcasting Report and the surge in national debt to over $31 trillion on October 4? Let us know what you think about the matter in the comments section below.

image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. This is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. Bitcoin.com does not provide investment, tax, legal or accounting advice. NEITHER THE COMPANY NOR THE AUTHOR WILL BE LIABLE, DIRECTLY OR INDIRECTLY, FOR ANY DAMAGE OR LOSS ARISING OR ALLEGED TO OCCUR ARISING OUT OF OR RELATING TO YOUR USE OF OR RELIANCE ON ANY CONTENT, PRODUCTS OR SERVICES DESCRIBED IN THIS ARTICLE. We are not responsible.

Federal Reserve Inflation Nowcasting Data Shows Future CPI Increase, US Total Debt Hits $31 Trillion

Source link Federal Reserve Inflation Nowcasting Data Shows Future CPI Increase, US Total Debt Hits $31 Trillion